|

|||

|

|

|

||

|---|---|---|

|

||

|

||

|

||

|

||

|

||

|

||

|

|

|

|

Understanding FHA Streamline Refinance and PMI: A Comprehensive GuideThe FHA Streamline Refinance is a popular option for homeowners looking to refinance their existing FHA loans with minimal hassle. This process is designed to reduce paperwork and simplify the refinancing process. However, one important aspect to consider is Private Mortgage Insurance (PMI), which can affect your monthly payments. What is FHA Streamline Refinance?The FHA Streamline Refinance is a program that allows homeowners with existing FHA loans to refinance with less documentation and without the need for a home appraisal. This makes it an attractive option for those looking to reduce their interest rate or monthly payments quickly. Benefits of FHA Streamline Refinance

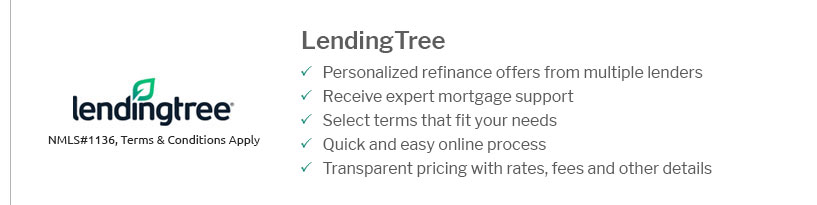

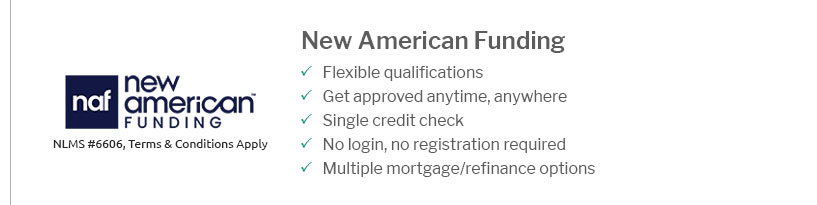

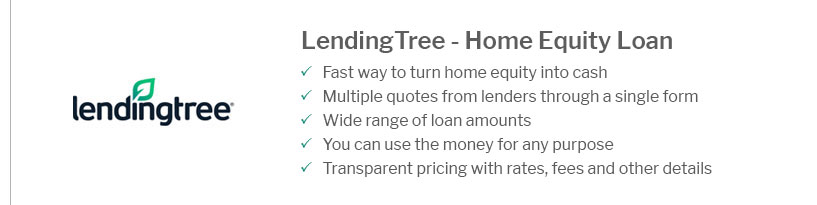

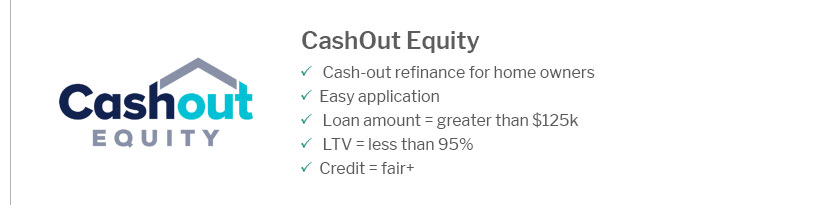

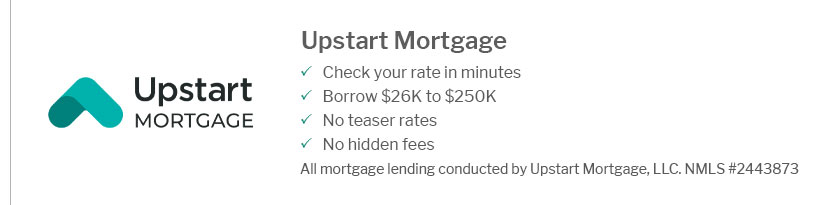

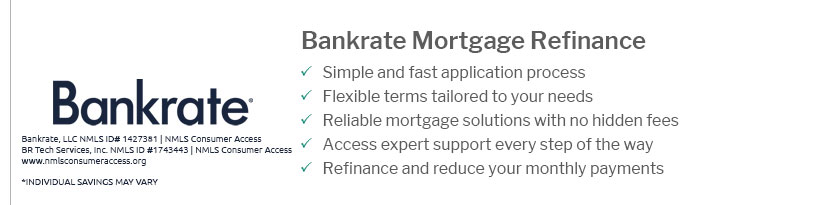

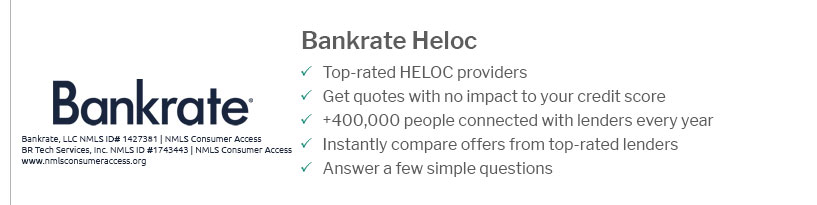

Understanding PMI in FHA LoansPrivate Mortgage Insurance (PMI) is an insurance policy that protects lenders in case of borrower default. FHA loans have their own version of PMI called the Mortgage Insurance Premium (MIP). How MIP WorksFHA loans require both an upfront MIP payment and an annual MIP payment, which is included in your monthly mortgage payment. The upfront MIP is typically 1.75% of the loan amount, while the annual MIP varies based on the loan term and amount. FAQ: FHA Streamline Refinance and PMICan I remove PMI from my FHA loan?PMI, or more accurately, MIP, cannot be removed from FHA loans originated after June 3, 2013, without refinancing into a conventional loan. Is the FHA Streamline Refinance available for all FHA loan holders?Most FHA loan holders qualify, but you must have a good payment history and the refinance must provide a tangible benefit. Does FHA Streamline Refinance require a credit check?No, FHA Streamline Refinance does not require a credit check, making it accessible to more homeowners. How does the FHA Streamline Refinance affect my interest rate?The primary goal is to lower your interest rate, but it's important to compare current mortgage rates, such as those found at mortgage rates louisville ky, to ensure you are getting the best deal. Finding the Right LenderChoosing the right lender for your FHA Streamline Refinance is crucial. It's important to research and compare offers from different lenders. Consider checking out top mortgage lenders us to find competitive rates and terms. In conclusion, the FHA Streamline Refinance offers a simplified option for homeowners looking to reduce their mortgage payments. By understanding the role of PMI and exploring your lender options, you can make an informed decision that best suits your financial situation. https://www.hud.gov/sites/documents/15-01mlatch.pdf

Annual Mortgage Insurance Premium (MIP). Applies to all mortgages except: Streamline Refinance and Simple Refinance mortgages used to refinance a previous FHA. https://www.fha.com/fha_requirements_mortgage_insurance

FHA requires both upfront and annual mortgage insurance for all borrowers, regardless of the amount of down payment. https://www.freedommortgage.com/fha-loans-streamline-OLD

If you're a homeowner with an FHA loan, a streamline refinance is an easy way to take advantage of lower interest rates. The streamline program lets you replace ...

|

|---|